Will Trump Torch the Global Economy on the Bonfire of his Vanity?

Tom Luongo

At least it is confirmed for us. Donald Trump wants regime change in Iran. His cancellation of the JCPOA was a decision born his myopia. He has surrounded himself with people who reinforce his view and manipulate him via his vanity.

And the price of implementing his current plan will be a global debt crisis which no one will escape. The problem will be very few will see the links.

He wants to remake America and the world in his image while undoing anything President Obama touched. Most of this I’m wholly on board with. Obama was a vandal. So, however, were Bush the Lesser and Bill Clinton.

We’re All Neocons Now

We have a leaked (yeah, right) memo explaining this is the plan. But, we didn’t need this if we were being honest with ourselves. Nothing Trump has done since he’s been in office has been contra to this goal; overthrowing the theocracy in Iran.

In fact, it has been a step-wise move in this direction with each decision he’s made. Commentators I respect and have learned at the knee of still want to give Trump the benefit of the doubt. Not me.

It’s right there in plain text.

Trump has capitalized on the insane Deep State opposition to his presidency to politicize this goal and get his base to ab-react for regime change, when he explicitly said that was off the table at his inauguration.

If the Democrats and Merkel want to stay in the deal, then the deal must be bad. Obama Bad, Trump Good. Trump is Orange Jesus. He knows stuff, man.

What was a worry about Israeli influence in his administration in 2017 has now morphed into a call to duty to create chaos in Iran to assuage the American ego by saving the Iranian people from themselves.

You have to hand it to these folks, they understand how to run a successful mass psy-op. Beware the Master Persuader, as Scott Adams would put it, his skills can be put to any use.

These men and their Deep State handlers/billionaire donors have had a strategic goal for decades, remake the Middle East for Israel and the Oil Complex, bottle up Russia and China.

Donald Trump’s patriotism is revealed to be jingoism. But, he made this clear in his speech to the U.N. last year. At some point you have to put away childish things and face the world we’ve got.

And that world is one of extreme uncertainty.

Back to the Future

As I said the other day, Trump wants to reset the clock back to 2012. Bottle up Iran, cut its ties to the world. Remove 1 million barrels of oil per day from the markets (for his Saudi weapons customers “Look! Yuge JOBS!”). And bully our allies into getting the plan to atomize Syria back on track.

But, it’s not 2012. It’s 2018 and everything is different. Iran has friends it didn’t have then. Yes, there is local unrest and unhappiness which could grow. The rial is falling like a rock, people in Iran can’t get dollars. Not solely because Trump has cut them off from the dollar but because Iran has.

It anticipated this move by him and the chaos of today turns into the de-dollarization of tomorrow. These people still think destroying a national currency is the path to political change. It’s a dangerous gambit that doesn’t always work.

It didn’t work with Russia in 2014/5. It’s not working in Venezuela today. And if those countries have friends, China for Russia in 2015, Russia and others for Venezuela today, then the longer the regime stays in power once the worst of the crisis hits, the lower the probability regime change becomes.

I told everyone last year the Saudi gambit to isolate Qatar wouldn’t work. If they didn’t get regime change in Doha within two weeks, then the government would survive. It has and now it is free to pursue whatever it wants, having finally bought a 19% stake in Russian state oil giant Rosneft.

Trump has been signaling this moment for almost two years. Do you think Russia, Iran and China have not been game-planning this? When the attack on the ruble began in 2014, Putin did the unthinkable. In doing so revealed his central bank’s disloyalty.

By demanding to free-float the ruble, under objection from his economic advisor Alexander Kudrin and central bank President Elvira Nabullina, Putin stabilized the situation quickly. Then he ordered the Bank of Russia to assist payment of more than $50 billion in Russian corporate debt denominated in dollars from central bank reserves.

China opened up ruble/yuan swap lines to help funnel dollars into Russia. The Bank of Russia had to abandon IMF-style austerity and serve Russian interests first rather than continue playing into the hands of U.S. hybrid war tactics.

Iran has these people as its friends now. They are committed to its survival. They may not be committed to the IRGC staying in Syria post-ISIS/Al-Qaeda, but they are committed to an Iran aligned with them for the road ahead. And that Road has a Belt attached to it.

Because they know that if they lead the opposition to U.S. aggression, then they will gain allies over time. In acting this way Trump is revealing the U.S. to be the repressive, messianic global oligarch of the world order it claims the Iranian Islamic Republic to be over its citizens.

Everyone will get in line behind the Orange Emperor or suffer his wrath. Why? Because Bibi Netanyahu can’t sleep at night? Get that psychopath a plushie and leave a night light on for pity’s sake.

It also has an EU wanting to establish itself as a separate power from the U.S. Angela Merkel and French Poodle Emmanuel Macron both want an independent EU foreign policy and a Grand Army of the EU to put down any internal rebellions.

China can and will assist Iran in overcoming the sanctions. So will Turkey, who did so in 2012. Will it be enough save the Islamic Republic? Possibly. If that happens will the U.S. get what it wants?

Most probably not. National Security Advisor and Certified Crazy Person John Bolton wants to put the Saudi-backed MEK (Mujahedeen-e-Khalq), a cult-like Sunni group with zero support in Iran. You’ll hear in the coming days about how great these guys are.

Just like U.S. NGO-backed Russian agitator Alexei Navalny is promoted in the Western press even though he can’t get 2,000 people to march in Moscow on the day of Putin’s inarguration.

Sanctions Cut Both Ways

Russia, ultimately, has the sanctions hammer in its control of the uranium market. It’s also a major supplier of both titanium and aluminum. The U.S. has never considered sanctioning the first two and it’s plan to sanction Rusal has been close to a disaster.

Trump believes in the primacy of the U.S. threat both militarily and financially so much that he’s willing to project it everywhere and at everyone to get what he wants in Iran. We thought he reluctantly signed those new sanctions last summer. Nonsense.

If so, he wouldn’t be using those new powers in ways that are the height of hubris. Explicit in his threats to Iran and his demands that are, as Alexander Mercouris put it at The Duran yesterday, “so extreme that no sovereign state could ever accept them and retain its independence.”

So, let’s again put away childish things and think that Trump will not take this to whatever point he thinks is necessary to get his desired outcome.

But, in doing this he will upset world financial markets already fragile from a decade of QE and an explosion of cheap dollar-denominated debt. The Fed is raising interest rates. Bond traders are resisting raising rates at the long-end of the U.S. Treasury yield curve, causing it to flatten dangerously.

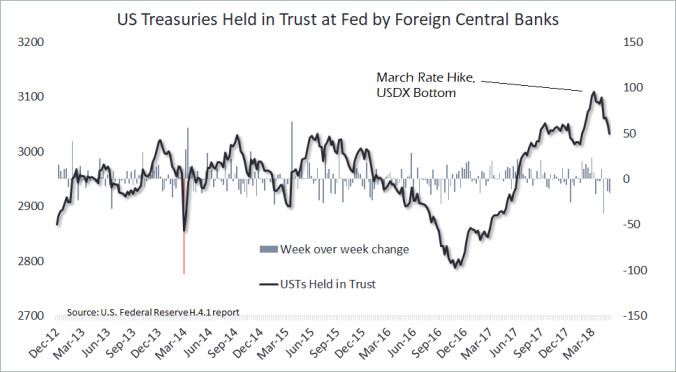

Trump wants a continued weaker dollar but geopolitical uncertainty creates dollar demand because so much of the world’s debt and trade is based in it. For over a year Foreign Central Banks have been parking U.S. Treasury purchases with the Fed as the dollar weakened.

Now that trend has firmly changed.

The Dollar Debt Bomb

Moreover, the ECB is trapped at the negative-bound. Mario Draghi keeps telling everyone he has no Plan B. He will keep being the marginal (or only) buyer of EU sovereign debt until the market finally pukes all over him.

If Trump is serious about putting sanctions on any foreign entity that does any business with Iran then that will set off chain reactions around the globe. It’s why I’m not sanguine about EU leadership standing up to Trump in the long run.

But it’s a real opportunity for Merkel et. al. to establish a new pole in the proposed multi-polar world advocated by Putin and Chinese Premier Xi Jinping.

The worry now is a technical breakout of the U.S. 10 year above 3.05%. U.S./EU credit spreads With the dollar strengthening low loan servicing costs become big quick. Anyone who has/had an adjustable rate mortgage understands this viscerally.

With China no long buying U.S. debt, it is free to funnel dollars to Iran through proxies and its own oil trade to keep things from escalating. That lack of recycling of its trade surplus is part of what kept the dollar weaker longer. Now that the dollar is rising, we can safely say that that effect has been over-run.

China can and will put pressure on the Saudis by buying more Iranian oil. Expect Iran now to cut it’s monthly tender price to undercut Saudi Arabia on a forward basis. In 2012 U.S. sanctions made it difficult for shippers to insure oil shipments and that was part of the reason they were initially so successful.

With the Fed tightening, reserves of the U.S. banking system are falling thanks to excess reserves being mobilized. The U.S. budget will strain from rising debt servicing costs, now above 8.6% of total outlay, compared to less than 8% this time last year. Again this puts upward pressure on the dollar as foreign markets are starved of dollars.

Next, Trump wants more balanced trade with China and Europe and he’s willing to guy global trade to do it. But that also means a stronger dollar in the long run as debt still needs to be serviced while trade is falling.

Again, fewer exported dollars while the budget deficit grows. Emerging Markets are already suffering horrendous capital outflows. Just wait until things actually get bad.

Eurodollar markets have been drained of their liquidity in recent months as U.S. corporates repatriate funds and, like Apple, buy back their stock.

All of this points to reaping a whirlwind of dollar strength, not weakness, which to me, looks like the spark of the global debt crisis the Fed delayed for over a year by not raising interest rates sooner. It bowed to IMF pressure in 2014/15 to delay raising rates.

And the world is not prepared for the dollar spiking 20 or 30% over the next year. It is not prepared for a shift in risk assets stocks to bonds. A spiking dollar will create a perfect storm of debt defaults that will unleash chaos which will topple governments (and not Iran’s).

Trump will not react well to this, claiming, like all U.S. Presidents that China is manipulating its currency down to harm us. That’s utter nonsense. As I’ve laid out, Trump is creating the very whirlwind he’s trying to avoid.

It’s why the DOW is holding above 24,000. And why the euro is about to collapse.

Survival is Winning

So, here we are. This is why I keep saying China, Russia and Iran’s best moves politically are to do nothing overt. Iran was not the aggressor the other day. That’s another of Bibi’s blatant lies.

Russia looks weak by not responding to Israel’s spastic flailing the other day, but it knows that time is on its side. The SAA/IRGC and Russian forces continue to destroy pocket after pocket of resistance in Syria.

Putin will continue to hold his water, waiting for the opportune moment to reverse his opponent. Russia’s limit has not been reached in Syria yet. Putin always does this. It drives his critics and his supporters crazy.

It’s geopolitical judo and he’s the master at it. And when that reversal comes and Israel has been thrown flat on its back, Trump’s only move will be to settle. Why speculate on what he’ll do. Just watch and wait it out. The signs are all there.

When that happens John Bolton will retreat farther into madness, hopefully he’ll throw himself off a building and put us all out of his misery. Let’s hope someone’s iPhone captures it for posterity’s sake.

After a brief spasm in the financial markets thanks to Trump’s insane aluminum tariffs, Russian equities and the ruble are rallying.

In fact the MICEX Index just put in its all-time highest weekly closing price. Its sovereign debt markets are stable and the yield curve is widening. Capital is flowing into Russia despite horrific U.S. sanctions.

This is the model for Iran’s resistance.

Russia is winning the financial war of attrition and the stronger it gets the more it can support Iran in the long run alongside China.

This is the limit of Trump’s unwillingness to update his worldview from 2003. He’s held this view of Iran his entire life and surrounded himself with the ‘experts’ to take Iran out. Even if the Mullahs fall, the backlash from the process whatever form it takes will set the global debt markets aflame, a bonfire of Trump’s vanity.