Briefing for Representative Jim Jordan (OH-4th)

Critical Constitutional Matter for the House Oversight Committee

Prepared October 19, 2012

American and Russian Opportunists Undermining U.S. Sovereignty and Corrupting U.S. Financial and Judicial Systems

Tom Clancy couldn’t make this up. Sadly, the facts seem to point to a self-styled Facebook “ecosystem” of principals who are pressing an internationalist agenda that undermines U.S. sovereignty and corrupts U.S. financial and judicial systems. They are also exploiting the innovations and stolen intellectual property from Ohio-based Leader Technologies to achieve their goal.

Facebook has one billion users—three times the U.S. population. Their continued unscrupulousness cannot be anything other than an external shock to our financial system. Congress needs to act to prevent more damage.

Lawrence Summers

Lawrence Summers, who has held numerous senior positions in both the Presidents Bill Clinton and Barack Obama White Houses, looms large in this Facebook “ecosystem,” as do two of his protégés, American Sheryl Sandberg and Russian Juri Milner. Summers recently popped up in Silicon Valley as a newly-appointed “special adviser” to Facebook director, Marc Andreessen; coincidentally while Andreessen was completing a dubious $1 billion Facebook acquisition of Instagram — a company with 13 employees and no revenue. Andreessen was (and continues to be) a director in both companies. Summers also accepted appointment to the board of a financial transactions company, Square — a curious development given Facebook’s evident plan to make Facebook Credits an unregulated global currency. Summers’ interconnections within the Facebook “ecosystem” are astounding, most notably Summers’ 20-year World Bank associations with (a) Facebook COO Sheryl Sandberg, (b) Facebook’s second largest investor, Moscow-based Juri Milner and his companies Digital Sky Technologies and DST Global, and (c) Goldman Sachs and Morgan Stanley to whom Summers provided $20 billion in U.S. taxpayer bailout funds while chief of President Obama’s National Economic Council.

Goldman Sachs & Morgan Stanley

Goldman Sachs is an equity partner in Digital Sky Technologies (aka DST Global) with Juri Milner and Russian oligarch Alisher Asmanov. This partnership appears to have been created prior to the $20 billion bailout of Goldman Sachs and Morgan Stanley by the U.S. taxpayers in 2008. DST has invested up to $3 billion in Facebook. Goldman Sachs’ involvement in DST raises the obvious question as to whether DST may have used TARP funds to invest in Facebook. Goldman Sachs obfuscated when asked by Senator Chuck Grassley on July 24, 2010 where the bailout funds went that Goldman distributed to its partners overseas. Who in this administration said that was permissible? Goldman Sachs also underwrote a multi-billion dollar private market in Facebook’s insider stock sales while blocking American investors from participating. Fortune said the DST funds had “unknown origins.” Did Juri Milner use TARP funds received from Goldman Sachs to invest his billions into Facebook stock? Milner was involved in the late 1990’s in Bank Menatep which was caught laundering billions for the Russian mob as well as diverting $10 billion in World Bank and IMF funds.

Economist Code of Ethics

A recent gathering of American economists were highly critical of economists who use their knowledge of global financial systems for personal gain. Where does Lawrence Summers fall along the ethical continuum involving “recommend[ing] policy prescriptions that served their clients’ interests, at the expense of the economy as a whole?”This Wall Street Journal article continued “A leading group of academic economists has adopted conflict-of-interest rules in response to criticism that the profession not only failed to predict the 2007-2008 financial crisis but may actually have helped create it.”1

Sheryl Sandberg; Juri Milner; Moscow State University; The Russian Academy of Sciences; DST (aka Digital Sky Technologies); Oligarch Alisher Asmanov

The three figures in the Facebook “ecosystem”—Summers, Sandberg, Milner—appear to be at the epicenter of an international scheme to fleece the American public by using corrupt legal tactics, steal intellectual property required to implement the collusion, and establish an unregulated global money system. Remarkably, these three individuals played a central (and quite destructive) role in the early 1990’s in the failed Russian voucher system that spawned the current oligarchy economy in the former Soviet Union. Now they have one billion current users of their core (stolen) technology and would have a significant impact on the U.S. and world economies.

The curriculum vitaes of these individuals follow, compiled from publicly available sources.

Numerous Leader shareholders reside in Ohio’s 4th Congressional District which Congressman Jim Jordan represents.

Are the facts, opinions and circumstances herein merely a random string of unflattering coincidences, or are they evidence of a more nefarious agenda?

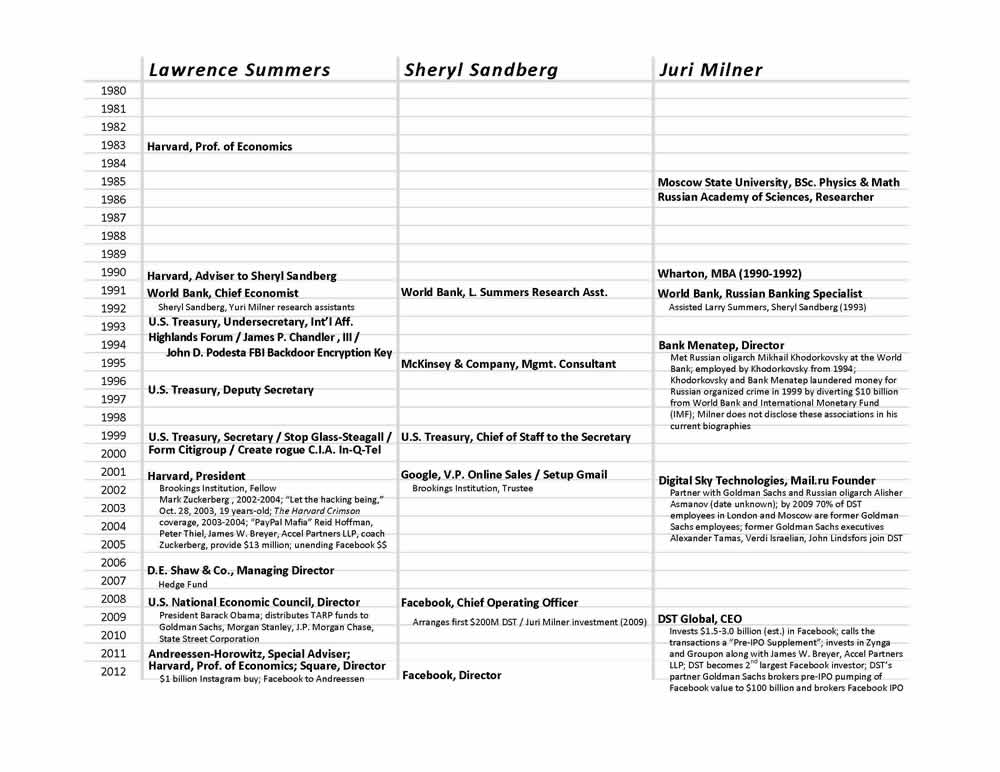

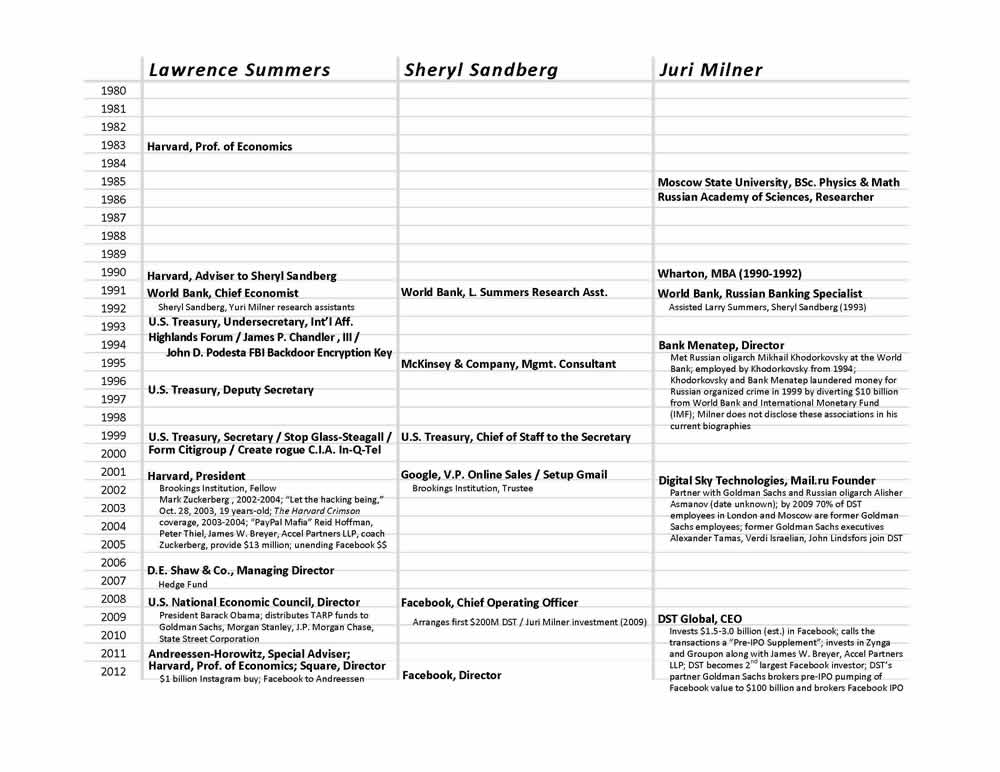

Click the image to enlarge the Summers-Sandberg-Milner biographies timeline

Figure 1: Biographies of Lawrence Summers, Sheryl Sandberg and Yuri Milner

Timeline

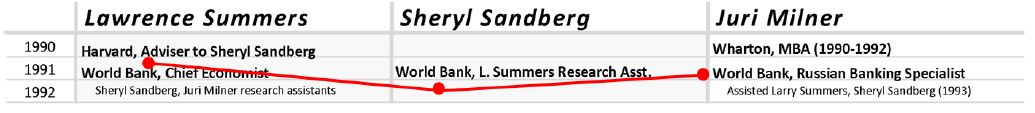

1992

Between 1991 and 1993 “

wunderkind professors of economics” including

Larry Summers were unleashed as “ersatz policy ‘experts’” by the

World Bank to implement their “flawed” plan for privatization of banking in the

Soviet Union.

2 This reckless voucher system resulted in the emergence of the current system of corrupt Russian oligarchies controlled by the

Kremlin; oligarchies that Summers is now exploiting.

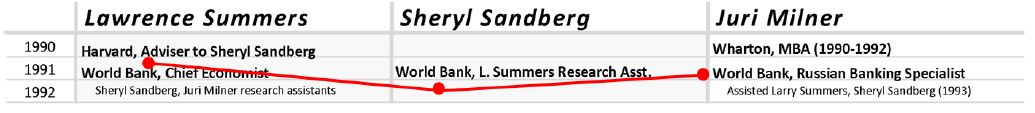

Click image to enlarge

Figure 2: Summers, Sandberg and Milner were proponents of a Harvard-wunderkind-led, neo-classical Russian voucher privatization system that devastated reform and created the current oligarch system. They appear poised to finally capitalize on this tragedy via the Facebook “ecosystem.”

1993

In 1993

Larry Summers with

Sheryl Sandberg’s assistance engaged the energies of a then-Wharton MBA student, Russian

Juri Milner, to write the

World Bank paper “Voucher Investment Funds” advocating the

Russian voucher system3 in their “insane and unnecessary haste.”

4

1994

While at the

World Bank working with

Larry Summers and

Sheryl Sandberg,

Juri Milner met

Russian oligarch Mikhail Khodorkovsky. He returned to Russia and worked for Khodorkovsky who owned

Bank Menatep which in 1999 became involved in the diversion of $4.8 billion in

IMF funds.

5 This money-laundering of an estimated $10 billion by the Russian mob via Bank Menatep also involved

World Bank funds.

6 Tellingly, Juri Milner does not disclose this association in any of his current biographies. Milner’s activities between 1994 and 2007 are murky.

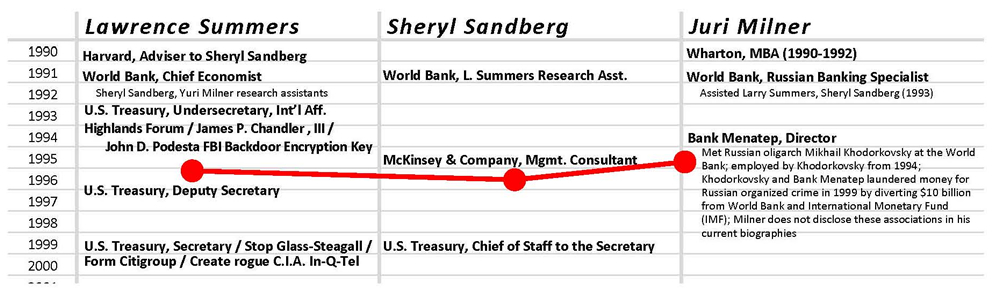

1999-2001

Sheryl Sandberg served as Larry Summers’ Chief of Staff at the U.S. Department of the Treasury while he was Secretary of the Treasury under President Bill Clinton.

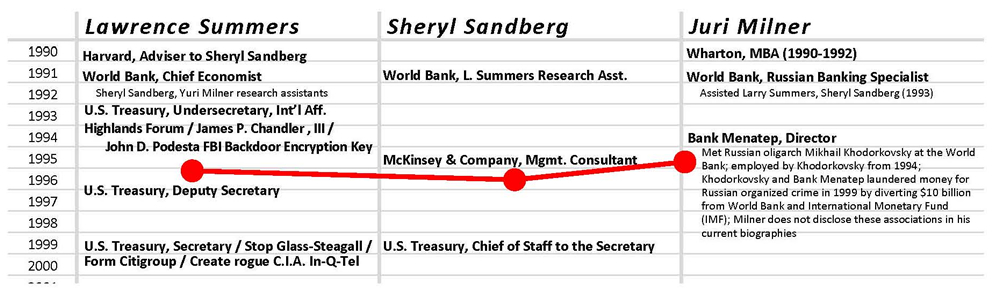

Click image to enlarge

Figure 3: While Summers and Sandberg worked for President Bill Clinton in the Treasury Department, Summers’ protégé Juri Milner worked at Bank Menatep, which laundered billions of dollars for Russian organized crime and diverted $10 billion in funds from the World Bank and the IMF.

2001

Between 2001 and 2003 Fenwick & West LLP represented Columbus, Ohio inventor Leader Technologies as counsel and was privy to Leader’s trade secrets.

2002

In late 2002

Leader Technologies filed for patents on its innovations, now called “social networking.”

7

Earlier, in early 2000, Leader’s patent attorney James P. Chandler, III began learning about Leader’s innovations after he had entered into multiple legal attorney-client engagement letters, promising to keep Leader’s innovations strictly confidential. Hindsight shows that as fast as Chandler was learning about Leader’s innovations, he was secretly feeding them to the IBM Eclipse Foundation, who was in turn feeding the inventions to a rogue C.I.A. operation who was in the process of weaponizing the Internet. Zuckerberg and Facebook were one of their creations. Zuckerberg was a C.I.A. stooge.

2003

During 2003 Leader Technologies prepared its innovations for market. New testimony reveals that Mark Zuckerberg and his Harvard roommates Dustin Moskowitz and Chris Hughes learned about Leader technology in early 2003, stalled other students working on other “facebooks” during the year, received a copy of Leader’s platform source code on about Oct. 28, 2003, and used it to launch Facebook on Feb. 4, 2004.

2003

Oct. 23

From Oct. 23, 2003 to Sep. 15, 2004

The Harvard Crimson carried 22 news articles about 19-year old sophomore

Mark Zuckerberg. Only

Bill Clinton and

George Bush received more mentions. Al Franken received 16, Google 14, Microsoft 10, Bill Gates and Pope John Paul II 3 each. By comparison, the two other “facebooks” at Harvard, namely the Winklevoss Twins’ Harvard Connection and Aaron Greenspan’s houseSYSTEM, received 4 mentions each.

Larry Summers was President of Harvard during this time,

8 creating the reasonable speculation that only he could have organized such inordinate coverage.

2004

May

By May 2004 former

PayPal co-founder

Reid Hoffman had become a first investor and business coach for

Mark Zuckerberg. He has just recently started claiming that he was the first outside investor in Facebook and introduced Zuckerberg to

Peter Thiel, his fellow former PayPal executive. This account is markedly different from earlier accounts that credit Napster founder

Sean Parker with the introduction. The story morphs with each new telling. If Hoffman did coach Zuckerberg at Harvard, this contradicts Zuckerberg’s testimony in

ConnectU where he makes no mention of Hoffman.

9

2004

Jun

In Jun. 2004, former PayPal co-founder Peter Thiel is introduced to Mark Zuckerberg by Reid Hoffman or Sean Parker (depends upon who is telling the story) and immediately invests $500,000.

2004

Jun 24

Leader Technologies’ patent on social networking publishes for the first time at the U.S. Patent Office. Zuckerberg hires Stephen Dawson Haggarty because the Leader code is too sophisticated to change. These changes in Groups functionality are heralded.

2005

May 26

James W. Breyer and

Accel Partners LLP announce publicly a $12.7 million investment in

Facebook.

10

2005

Oct 26

James W. Breyer of

Accel Partners LLP and

Mark Zuckerbergsolicit to induce third party developers at Stanford University to build apps on the

Facebook framework stolen from

Leader Technologies for the first time.

11

2006

Nov 21

On Nov. 21, 2006 Leader Technologies received U.S. Patent No. 7,139,761; the platform that is the Facebook engine.

(ca. 2002-2009)

Goldman Sachs has never disclosed exactly when they became a substantial investor in Moscow-based

DST (aka

Digital Sky Technologies) along with Russian oligarch

Alisher Asmanov and

Juri Milner, but they are believed to be “among DST’s five investors.”

12 Approximately 70% of DST’s employees and executives in London and Moscow are former Goldman Sachs employees.

13

2007

Oct 25

Microsoft invested $250 million in

Facebook.

14 Microsoft is implicated in the cover up of investments by the judges in Facebook and other conflicts of interest at the

Federal Circuit in

Leader v. Facebook.

15

2008

Mar 24

Sheryl Sandberg left Google (where she oversaw the creation of Gmail) and became Chief Operating Officer at Facebook.

2008

Oct 13

Facebook filed for an SEC exemption from the 500 shareholder rule. The exemption filed by Fenwick & West LLP, former corporate counsel to Leader Technologies.

2008

Oct 14

Facebook received an

SEC exemption from the 500 shareholder rule.

16 The ostensible purpose of the exemption was with regard to the “employee benefit plan” and “for compensatory purposes,” although hindsight finds deceptive language including the inserted phrase on page 2: “(and may in the future grant RSUs [Restricted Stock Units] to directors and certain consultants as well)” and “could in the future have more than 500 holders of RSUs” and “only be issued to employees and directors of the Company and consultants.” No reasonable person would read this disclosure to include a $3 billion dollar

Goldman Sachs “special purpose vehicle” to make a private “pre-IPO supplement” market that locked out American investors.

SeeJan. 7, 2011.

The one-day turnaround of this SEC exemption is remarkable.

2008

Nov 4

Goldman Sachs,

Morgan Stanley and

State Street Corporation received $22 billion in bailout funds from U.S. taxpayers in the “First Tranche” of the

Emergency Economic Stabilization Act of 2008 (EESA).

17 Former

FDIC Chief Sheila Bair says it was not necessary. Could the agendas finally be revealed in this briefing?

18

2008

Nov. 19

Leader Technologies sues Facebook for patent infringement captioned

Leader Technologies, Inc., v. Facebook, Inc., 08-cv-862-JJF-LPS (D.Del. 2008).

19

2008

Nov. 23

Larry Summers nominated by

President Barack Obama to head of the

National Economic Council despite criticism that Summers played a role in the 2008 economic meltdown.

20

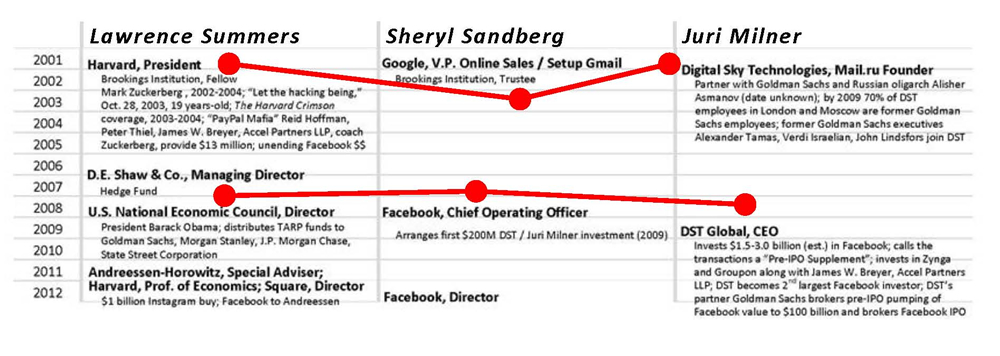

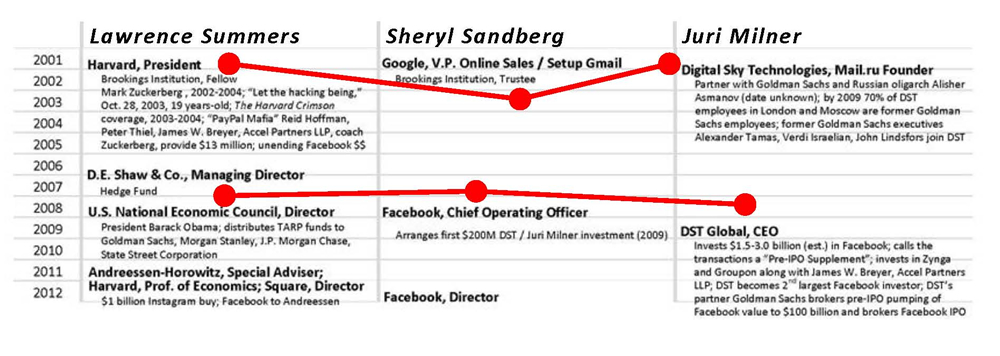

Click image to enlarge

Figure 4: Summers and his protégés make their moves to consolidate their holdings in the Facebook “ecosystem” having (a) stolen the Facebook platform technology from Leader Technologies, (b) fleeced a $3 billion private market of investors to pump up the pre-IPO valuation to $100 billion, and (c) fleeced the public market again by raising over $10 billion in cash at an inflated valuation while the insiders cashed out over $13 billion of their shares on Day 3 of the IPO. Juri Milner alone sent about $3.79 billion back to Moscow. Accel Partners LLP and James W. Breyer pocketed $6.5 billion.

2009

May 26

Mark Zuckerberg announced a $200 million investment from

DST Moscow and

Juri Milner, arranged by his new COO,

Sheryl Sandberg. Zuckerberg said Facebook is relying on DST for its

Facebook Credits strategy.

21

Figure 5: Facebook Credits Word Mark – The new world currency?

USPTO, Ser. No. 77934145, Filed Feb. 11, 2010.

2009

Jul. 24

Fenwick & West LLP discloses

Leader Technologies’ patent as a prior art reference on

Marc Andreessen’s social networking patent applications, but subsequently fails to do so on all of Facebook 700+ patent applications. This

willful fraud, called “inequitable conduct” in the patent world, if true, created a strong motive for Fenwick & West to undermine Leader Technologies, their former legal client in 2001-2003.

22

James W. Breyer: His money is not on the United States. (Breyer extracted $6.5 billion on Day 3 of the IPO at $37.58 per share)

2010

Feb. 1

Facebook’s Chairman and largest investor James W. Breyer, Managing Partner of

Accel Partners LLP Palo Alto, CA said in Munich, Germany that the decline of venture investing in the U.S. is “probably a good thing” and says there is “enormous opportunity globally” and that new venture capitalists should be “on a plane to London, Bangalore and Beijing, and not necessarily Palo Alto, California;” apparently selling the U.S. short.

23

Collusion with Foreign Powers Is Destabilizing U.S. Financial Interests and Property Rights

2010

Jul. 24

Goldman Sachs disclosed that they sent $4.3 billion of the taxpayer stimulus funds overseas.

24 Both

Goldman Sachs and

Morgan Stanley have also admitted using

TARP funds to pay executive bonuses.

25 Given this questionable conduct in supporting concealed “ecosystems,” did they also send money to their

DST-Moscow business partners? Were some of these funds used in Goldman’s Jan. 2011 self-described multi-billion dollar “pre-IPO supplement” private market by DST-Moscow,

Juri Milner and tight-with-the-Kremlin

oligarch Alisher Asmanov26 (who became the second largest

Facebook stockholders behind

James W. Breyer and

Accel Partners LLP)?

2010

Jul. 27

The

Leader v. Facebook patent infringement trial results in a split verdict.

Facebook was found guilty of infringement on all 11 of 11 counts.

Leader Technologies lost on a dubious “on-sale bar” claim.

27 Overturn of the jury seemed likely given the jury’s admission to the judge that they had no evidence and the “clear and convincing” burden of proof is a “heavy burden.”

2010

Aug. 5

Judge Leonard P. Stark’s appointment by President Barack Obama was confirmed by the U.S. Senate, just nine (9) days after the Leader v. Facebook split verdict.

2011

Jan. 3

Goldman Sachs uses the

SEC exemption obtained by

Fenwick & West LLP on Oct. 14, 2008, which was created as a “special purpose vehicle” to pool thousands of investors, but count them as one investor, and make a private market in Facebook insider stock.

28Goldman Sachs then infused $500 million into

Facebook; $50 million from Goldman itself, and $450 million from

DST Moscow. This investment pumped Facebook’s valuation to $50 billion.

Fortunemagazine described the source of

Alisher Asmanov’s funds as “not clear.”

29 Tellingly, Fenwick does not disclose such a “special purpose vehicle” intent to the SEC.

See Oct. 13-14 2008.

2011

Jan. 18

Goldman Sachs “slammed the door on U.S. clients” (

The Wall Street Journal) from participating in the private offering of

Facebook stock after receiving inquiries from the brokerage community about the 500 shareholder rule.

30

Longstanding SEC rules required Goldman Sachs to have counted each of these pooled investors separately. Otherwise, brokerage houses could create private markets for any client by first buying the client’s stock, subdividing the stock themselves, then make their own private, unregulated stock exchange—which is exactly what Goldman did. Consequently, by the rules other companies must follow, Facebookbecame a de facto, noncompliant public company in January of 2011. Nonetheless, the 2008 SEC exemption request by Fenwick & West LLP appears to have been the ruse that Goldman Sachs would use as its ostensible authority to pursue this private market; effectively taking Facebook over the 500 shareholder rule five-fold (this number had never been disclosed; including not in the S-1).

Facebook used $1 billion of this unregulated pre-IPO money to make the dubious purchase of Instagram in which Larry Summerspopped up suddenly as a Marc Andreessen “special adviser.”

2011

Mar. 14

Judge Leonard P. Stark refused to set aside the on-sale bar verdict in Leader v. Facebook; forces Leader Technologies to appeal.

2011

Mar. 31

DST’s Juri Milner of Moscow, Russia, purchased a 25,000 square foot, 11 acre Silicon Valley mansion for $100 million; called “one of the most expensive homes in the U.S.”

31 More use of TARP funds?

2011

Jun. 28

Goldman Sachs announced it would outsource 1,000 American jobs to

Singapore.

32

Fenwick & West LLP—Material Securities Nondisclosure

2012

Feb. 1

Facebook,

Goldman Sachs,

Morgan Stanley and

Fenwick & West LLP issue the first of many iterations of the Facebook S-1 registration and

systematically failed to disclose the risks to investors associated with the verdict of “literal infringement” on 11 of 11 counts of patent infringement

33 of

Leader Technologies’ U.S. Patent No. 7, 139,761.

34

Fenwick & West LLP—Material Breaches of Attorney-Client Privilege

2012

Apr. 16

Fenwick & West LLP’s attorney

Tyler A. Baker, speaking for Managing Partner

Gordon K. Davidson (the lead Facebook IPO attorney;

See Facebook S-1 tombstone),

35 denied any conflict of interests as

Leader Technologies’ corporate counsel and close collaborator with Leader’s patent attorney

Professor James P. Chandler during the 2001-2003 when Leader’s patents were being prepared. Leader Technologies said that Fenwick did not seek a

conflicts waiver before agreeing to represent Facebook. Leader had given Fenwick & West LLP copies of Leader’s invention source code for their client files to which multiple Fenwick personnel had access.

2012

May 8

On the same day that Facebook began its IPO Road Show in New York City, the Federal Circuit Court affirmed Facebook guilty of “literal infringement” on 11 of 11 counts, but refused to overturn the jury’s dubious “on-sale bar” ruling in Leader v. Facebook. Leader petitioned for rehearing citing the numerous mistakes of law. See Jul. 27, 2010.

2012

May 22

Day 3 of the IPO:

Facebook insiders cashed in $13.26 billion of their shares in a

coordinated sell-off at $37.58 per share. Facebook Director

James W. Breyer and his company

Accel Partners LLP cashed in $6.5 billion of their Facebook stock. The sell-off also included

Microsoft ($246 million),

Peter Thiel ($633 million),

Mark Zuckerberg ($1.13 billion),

Goldman Sachs ($914 million),

Meritech Management ($263 million) and

Juri Milner / DST / Digital Sky Technologies / Mail.ru ($3.79 billion).

36

Material Undisclosed Judicial Conflicts of Interest

2012

May-Jun.

Judicial financial disclosure filings revealed that at least two of the three

Leader v. Facebook judges, namely

Presiding Judge Alan D. Lourie37 and

Judge Kimberly A. Moore,

38 have substantial

undisclosed investments in Facebook.

39

2012

Jun. 29

Lawrence Summers appears, unexpectedly according to the financial press, as “special adviser” to

Marc Andreessen at

Andreessen-Horowitz just in time to cash in on the dubious $1 billion

Instagram purchase by

Facebook.

40

2012

Jul. 10

Internet pioneer, inventor and former Sun Microsystems Director of Network Architecture,

Dr. Lakshmi Arunachalam files an

amicus curiae (friend of the court) brief on behalf of the public, pointing out the egregious mistakes of law in

Leader v. Facebook.

41 Her motion was

never docketed by the

Clerk of Court Jan Horbaly, but was nonetheless denied by the Court.

Material Evidence Withheld by Mark Zuckerberg; Federal Courts Are Coddling Facebook42

2012

Jul. 19

Facebook experts reveal in the

Paul Ceglia v. Mark Zuckerberglitigation that

Mark Zuckerberg concealed 28 computer hard drives and

Harvard email archives in

Leader v. Facebook. The

Federal Circuit Court ignored this explosive new evidence.

43

2012

Jul. 27

Dr. Arunachalam files a renewed motion pointing out the egregious and undisclosed conflicts of interest inside the Court.

44 This motion was

never docketed by the

Clerk of Court Jan Horbaly.

2012

Aug. 10

Federal Circuit Court issued a surprising four-page Order denying Dr. Arunachalam’s July 27, 2012 renewed motion (even though the Clerk of Court had never docketed it). The Order containing numerous false and misleading statements evidently designed to cover-up judicial misconduct.

2012

Aug. 21

Facebook director

Peter Thiel dumped another $400 million of his

Facebook shares on top of the $633 million he dumped on Day 3 of the IPO prompting

CNBC’s Jim Cramer to ask live on camera “where’s the outrage?”

45

Banana Republic Cronyism at the Federal Circuit

2012

Sep. 11

The Federal Circuit Bar Association filed a Request to have the Aug. 10, 2012 Order be made precedential. This move would essentially

absolve the judges of their wrongdoing in this case.

46 Four of Facebook’s attorneys and Microsoft, one of Facebook’s largest shareholders, populate the “Leaders Circle” at this bar association.

Seebelow.

2012

Sep. 18

Amicus Curiae Dr. Arunachalam responded with a stinging critique of

The Federal Circuit Bar Association’s attempt to cover-up the judicial misconduct and failure to disclose conflicts of interest. This motion was also

never docketed by

Clerk of Court Jan Horbaly. The Bar Association also failed to disclose its own conflicts of interest in that four different Facebook law firms, namely

Fenwick & West LLP,

Gibson Dunn LLP,

Orrick Herrington LLP,

Weil Gotchal LLP, participate in the Bar Association’s “Leaders Circle” and one of

Facebook’s largest shareholders,

Microsoft, is a director of the Bar Association.

47 Such nondisclosure renders the Bar Association’s Request dubious at best.

Naked Corruption at the U.S. Patent & Trademark Office; Inequitable Conduct

2012

Oct. 17

The U.S. Patent Office Patent Trial and Appeal Boards has just

overruled its

two Examiners’

two reexamination rulings affirming Leader patent claims over the prior art in

U.S. Patent No. 7,139,761. They are attempting to have an Examiner invalidate ALL of Leader’s 35 claims in an administrative decision (only 11 claims were asserted at trial). Such action by the Patent Office exhibits unconscionable favoritism and evident collusion. The action is a naked attempt to protect

Fenwick & West LLP and

Facebook from having their 700+ patent filings invalidated for “inequitable conduct” (fraud).

48 See Jul. 24, 2009.

James W. Breyer’s Self-fulfilling Prophesy

It also appears that the U.S. Federal Courts and U.S. Patent Office are equally supporting Breyer’s prophesy. If inventors and private property are not protected, then American innovation is not worthy of investment.

Or, is all this just “innocent” and “coincidental?”49

In closing are cautionary words from Professor Hy Berman, eminent American historian, and Professor Emeritus of History at The University of Minnesota, who served as a political adviser to former Vice President Hubert Humphrey and is a close friend of former Vice President Walter Mondale.

“As an American historian, I am particularly concerned by the implications of allowing powerful forces to violate intellectual property rights. Our economic and industrial development was made possible by inventors, innovators, scientist and engineers who developed the technology undergirding our national development. Through our patent and copyright protection system, these innovators were able to be rewarded for their efforts. If intellectual property theft by the powerful and well-connected is not stopped, future innovation is jeopardized.”50

Abuse of the Public Trust

Opportunism means consciously taking selfish advantage of circumstances with little regard for what the consequences are for others. The opportunism described herein uses the special knowledge vested in “Facebook ecosystem” cronies whereby the economists and lawyers involved use their knowledge of the weaknesses or our public institutions for their own selfish and illegal gain.

Will we permit such misconduct to continue, or will we act? Will we act to right the injustices perpetrated in this matter against both the American and Russian peoples. Will we act to stop this flagrant abuse of the public trust?

America Is The Land Of Opportunity,

Not Opportunism

The Fleecing of Propriety

The evident agenda of the principal cronies in the Facebook “ecosystem” is to establish a means of international exchange via Facebook Credits that is free of U.S. legal and banking regulations. They appear willing to go to whatever lengths necessary, legal and illegal, to achieve this goal.

If the Facebook “ecosystem” is allowed to succeed, they will do so having fleeced the American public three times:

- 2003-2004 theft of a validly issued U.S. Patent No. 7,139,761 invented by Leader Technologies, Inc., Columbus, Ohio;

- 2008 fleece of the American public by the so-called “Economic stimulus” whereby Summers, Breyer, Milner and their cronies received American taxpayer dollars in a “legal” transfer of wealth to their cronies; and

- 2012 fleece of the American public by the Facebook IPO whereby, once again, Summers, Breyer, Milner and their cronies took American investor monies in another “legal” transfer of wealth to their cronies?

The Facebook “ecosystem” has learned that in aggression there is profit. Has the American public had enough? Are we going to let these people succeed with their opportunism, their abuse of due process, their theft of property, their abuse of power?

Finally, shall we let these unscrupulous people continue to press their agenda to establish a “virtual” world currency called Facebook Credits or similar systems emerging from “London, Bangalore and Beijing” using stolen technology and funds fleeced from the American public?51

If Congress fails to act, a financial “army” of more than one billion Facebook users (more than three times the U.S. population) who are poised to undermine our country. What damages will their external shock cause to our already weakly growing, battered economy?

Available from Americans For Innovation and

Against Intellectual Property Theft

http://www.fbcoverup.com/docs/library/2012-10-19-Briefing-for-Representative-Jim-Jordan-OH-HOUSE-OVERSIGHT-COMMITTEE-American-and-Russian-Opportunists-Undermining-U-S-Sovereignty-and-Corruption.pdf

http://americans4innovation.blogspot.com

October 19, 2012

Continue reading HERE.

___

http://www.leader.com/docs/Jim-Jordan-Briefing-and-Timeline.html