“The Mother Of All Party Crashers Took A Dump In The We IPO Punch Bowl”

ZeroHedge.com

A month ago, Scott Galloway, the best-selling author, well-known tech-industry pundit, and professor of marketing at New York University’s Stern School of Business, unleashed his special kind of wit and financial weaponry on WeWork’s recent S-1 filing. Writing on his “No Mercy / No Malice” blog, Galloway said any Wall Street analyst who believes WeWork’s worth over $10 billion is “lying, stupid, or both.”

Now, a month later, following debacle after debacle proving him correct, Galloway is back to explain how “math” blew the whole WeWork IPO farce up…

So, the mother of all party crashers took a dump in the We IPO punch bowl. The crasher? Math. The autopsy will show the shelving of this IPO was death by S-1.

This was a case of immunities kicking in after the requisite SEC disclosure. As the greater fool theory has hit a wall, We will now need additional capital from the private markets, who are no longer under the influence. The firm will be forced to sell equity/issue debt at a price substantially lower than they had anticipated. A price unimaginable just 30 days ago.

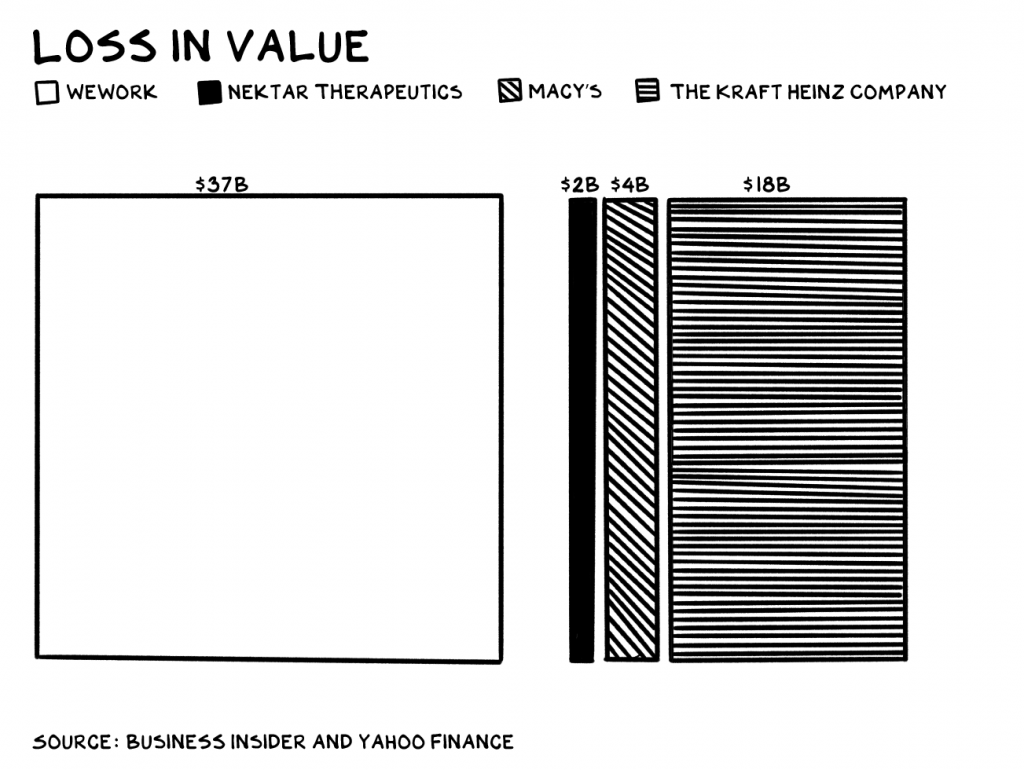

We has gone from unicorn to distressed asset in 30 days. In just seven days, We lost more value than the three biggest losers in the S&P 500 have lost in the last year combined: Macy’s, Nektar Therapeutics, and Kraft Heinz.

So, as a distressed asset, the playbook is fairly clear:

• Bring in new management. What got We here, isn’t going to get it where it needs to go. Each layer that comes off the We onion stinks more and more. The media has turned its attention to the Neumanns, and it’s as if the lights have been turned on at a cocaine-fueled party that ended several hours too late. Everyone and everything suddenly looks bad, scary even.

• The firm needs to bust a move to break even pronto. The new CEO should be from a REIT, ideally a hospitality or commercial real estate REIT. My vote is Adam Markman, CFO of Equity Commonwealth — Sam Zell’s firm.

• Shed/close all non-core businesses. WeGrow and WeLive are vanity projects. As someone close to the firm told me yesterday, they distract Mr. Neumann from the core business, where he was wreaking havoc. A $13 million investment in a firm that makes wave pools to indulge Adam’s passion for surfing. Really? Really?

• Raise money after an adult conversation with SoftBank (“You f*cked up, you trusted us. Do you want to participate in the next round or get washed out?”)

• Focus on margin expansion vs. growth. We has a differentiated product in the marketplace, and should command a premium.

• Lay off all employees not directly tied to managing the core business. Reprice options for remaining employees, as the current options are now worthless and most execs will begin looking for other jobs. The most talented (the ones with the most options) will be the first to leave if they aren’t given substantial economics for staying in Saigon as the North Vietnamese roll into town.

• 3-5 new independent directors. Boards have their own dynamic, irrespective of the qualities of the individuals. The members of this board have formidable experience/CVs. Lew Frankfort (Director) is a first-ballot Hall of Fame retail exec, and he doesn’t strike me as the type of guy who’d be bullied by the CEO, or anybody else for that matter. Again, I just can’t figure out what the f*ck happened here. Who is the head of the audit committee, and was he (they were all dudes until last week) the one passing out MDMA before each audit meeting? Or, as a private firm, did they even have audit committee meetings? This is a board that approved a $13 million acquisition of a wave pool company. Or did they?

The directors enabled an information pyramid scheme and indulged Adam, in exchange for hoping they could create enough valuation momentum, via nine rounds, to carry their shares to an exit in the public markets.

• SoftBank was reportedly considering propping up the IPO with $750 million in share purchases at the offering price. If that’s the case, shouldn’t they want to invest billions more at the now low-low 80%-off price? Or were they simply looking to pump and dump?

The above likely won’t happen. Why? As I said two weeks ago, the lines between vision, bullsh*t, and fraud are pretty narrow. I can’t wrap my head around what’s gone on here. Something is wrong. Something stinks. Something … Just. Doesn’t. Add. Up.

It’s beginning to smell like malfeasance at We. The lines between vision, bullsh*t, and fraud have been crossed here. To be clear, I’m not a journalist, nor a forensic accountant. This is pure speculation based on my experience as a CEO, investor, and director. Something is very, very wrong here. In no specific order:

• The board’s willingness to sell shares at 75% off (after seven days) says insiders knew the firm desperately needed money, and the price they advertised seven days before was not a real number (see above: malfeasance).

• Cult of personality firms seem especially vulnerable to massive declines in value or fraud. If you had to pick an analog for Adam Neumann (young, charismatic, visionary, with an outsized view of himself and a delusional view of the firm’s role in society), surrounded by gravitas/old white guys, who/what is more fitting than Elizabeth Holmes/Theranos?

• At the most recent all-hands (after the shelving of the IPO), Adam refused to take questions. Mr. Neumann is a narcissist, and to not indulge in a chance to spread more Adam means he’s now being advised by lawyers (“stick to your talking points, don’t say anything else, don’t take questions”). A bad sign.

If you liked the Theranos documentary The Inventor: Out for Blood in Silicon Valley, you’ll love Community-Based EBITDA: The Story of We, coming soon to Hulu.

At some point, tech’s gestalt of overpromise and underdeliver can paint founders into a corner where they begin massaging numbers (Earnings Before Gluten). I can relate to this. In ’99 I raised money from Howard Schultz (SBUX), Goldman Sachs, JPM, and a bevy of high-profile business people for an e-commerce incubator, Brand Farm. The company made no sense. But it was ’99, and a guy with some success, a good rap, and a shaved head could raise tens, if not hundreds of millions. My investors were nothing but supportive.

Bottom line, I didn’t have the courage/stomach to try to raise a B round, and I shut Brand Farm down. I was going to need to go “large” and spin our way to a $100 million round, and there was interest. But I was having trouble sleeping. When I get stressed, I stop eating. The correct diagnosis of my ailment was common sense mixed with a conscience. We’s mission to “elevate our consciousness” is sounding more apt with each WSJ story (some great reporting).

In sum, I can see how one gets in too deep and begins believing his or her own bullsh*t, almost as a defense/coping mechanism. I speak from experience: if you tell a thirty-something dude he’s Jesus Christ, he’s inclined to believe you.

We has consistently been so far off on any forecasts in their original pitch deck that it appears numbers are more of a nuisance than reporting metrics. Their forecasted profits: $14 million for 2014, $64 million for 2015, $237 million for 2016, $542 million for 2017, and (wait for it) $1 billion for 2018.

Except in 2018 the firm lost $1.6 billion, which is likely understated. SoftBank is the only investor since 2016, a rookie move in the world of investing. The lack of external, third-party validation can lead to everyone smoking their own supply, and more poor governance. Henry Hawksberry (pen name I think) wrote a blistering piece on Medium alleging, among other things, We was paying brokers 100% commissions, then figuring out how to turn expenses into revenues and pulling forward billables. If half of this is true, it’s fraud.

Ok, the wolves are closing in. What to do? I know, we’ll provide an exclusive to a network that throws us softball questions and provides a veneer of legitimacy. CNBC, that’s the ticket. We’ll distract from the boring stuff, like numbers, and bring with us early tech investor Ashton Kutcher. The third and and a half man is masterful and, sitting next to Adam, raptures:

“I realised it was a technology company. I also realised that this company, through its technology, has greater capacity than any other company in the entire world to bring people together.” Really, Ashton, really? Aren’t misleading metrics and nomenclature just non-carbonated fraud?

Why. Would. They. Leave?

The two most senior corporate communications exes, Jennifer Skyler and Dominic McMullan, both left recently, right before the IPO. Ok, so think about that. You are the belles of the ball of a firm about to IPO at $50 billion, and (in the case of Dominic) you announce, weeks before the IPO, “After becoming a dad (twice) in recent years, I’ve decided to take time off to spend with family in Brooklyn for now.” Yep, that makes sense. You know us men, always leaving right before the IPO to spend more time with our families.

The head of comms, Jennifer Skyler, left a few weeks ago for AMEX. Uh huh, that makes even more sense. Who wouldn’t want to bolt from the second-most-anticipated IPO of the year to go flack about the new American Express Marriott Bonvoy Brilliant Card. What’s worse than spending all day every day at home with two baby boys or downtown at AMEX? Engaging in fraud.

How did this happen?

A frothy market coupled with our gross idolatry of innovators creates an ecosystem that enables incremental disingenuous acts such that, if We had gotten public and managed to spend their way out of this hole, they might be lauded as “visionary.” What if Ms. Holmes had been able to raise another $2 billion and the technology had begun to show promise? Wouldn’t she be on Oprah and CNBC, instead of HBO?

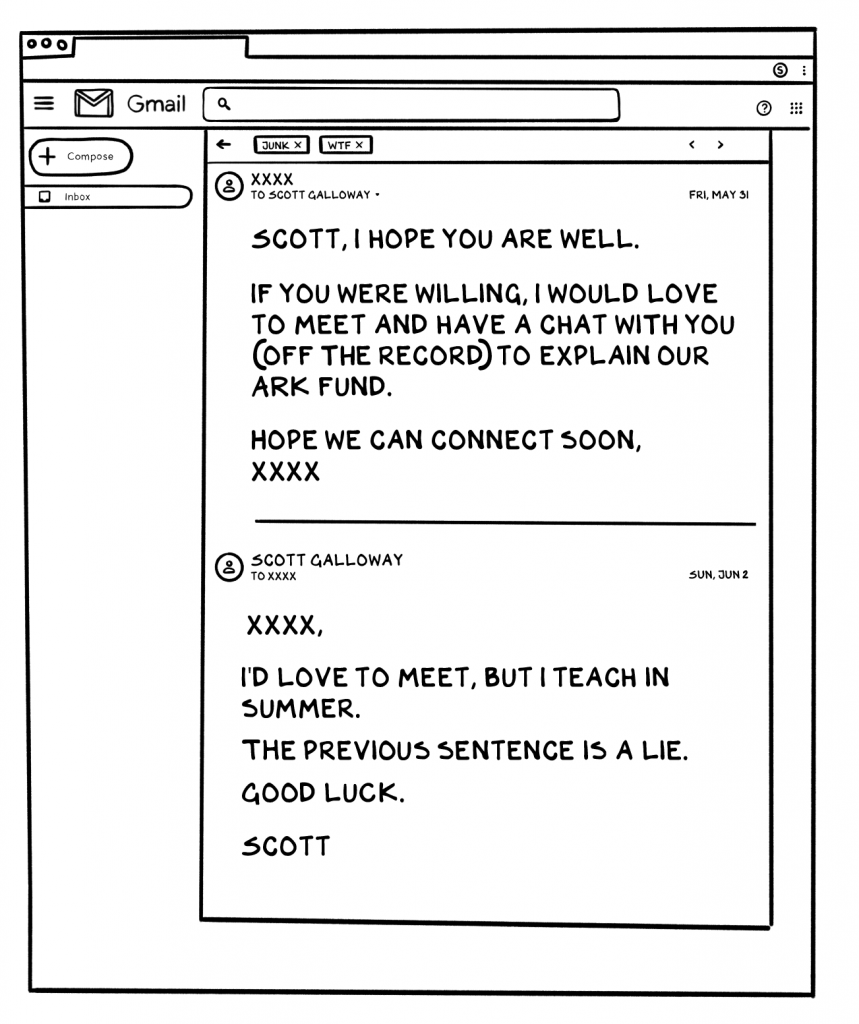

We’ve witnessed a halving of journalists since 2008, while the number of corporate communications execs has tripled. In sum, the ratio of bullshit/spin to watchdogs has increased sixfold. In the last 24 hours, I’ve been contacted by the BBC, WSJ, and WaPo to comment on We. But before any press outlet contacted me, I heard from a senior comms person at We, after I mentioned on Pivot in January that WeWork will be in the news a lot in 2019, for all the wrong reasons. Below is an email exchange I had with them in May. The subject was “Whipping Boy.”

As a general rule, I return the call of every journalist and refuse to meet with any corporate communications exec.

The halcyon of the markets coupled with feckless regulatory bodies and the decimation of investigative journalism has made the markets ripe for fraud. We is falling off the tree.

Predictions:

- In the next 30 days, a series of explosive investigative journalism pieces will document breathtaking malfeasance at We.

- In the next 60 days, a state attorney general, SEC, or other regulatory body will launch a formal investigations into We.

- Over the next 12 months, SoftBank’s Vision Fund will be shuttered.