Backlash: Hedge Fund Kicks Out Family That Makes OxyContin

ZeroHedge.com

As backlash against America’s painkiller addiction grows, hedge fund Hildene Capital Management has cut ties with the billionaire family that controls the OxyContin maker Purdue Pharma. According to The Wall Street Journal, Hildene fund manager Brett Jefferson forced the Sackler family who is invested in the $10 billion fund to start redeeming their investments.

“An opioid-related tragedy affected someone with a personal relationship to me and other members of Hildene,” Jefferson said in a statement, which he said occurred in 2017. At the time, the Stamford, Conn. hedge fund donated money to an organization fighting the opioid epidemic and has since contemplated ending the firm’s relationship with the Sacklers, he wrote.

“Last year the weight on my conscience led me to terminate the relationship and initiate the redemption procedure,” Jefferson wrote.

Hildene joins a long list of universities, museums, and nonprofits, including the New York Academy of Sciences and Columbia University, that have all questioned their relationship with the Family.

The Sacklers, who control Purdue which is considering filing for bankruptcy to limit its mounting legal liabilities, have come under immense pressure amid hundreds of pages of courts documents released as part of lawsuits filed by Connecticut and Massachusetts.

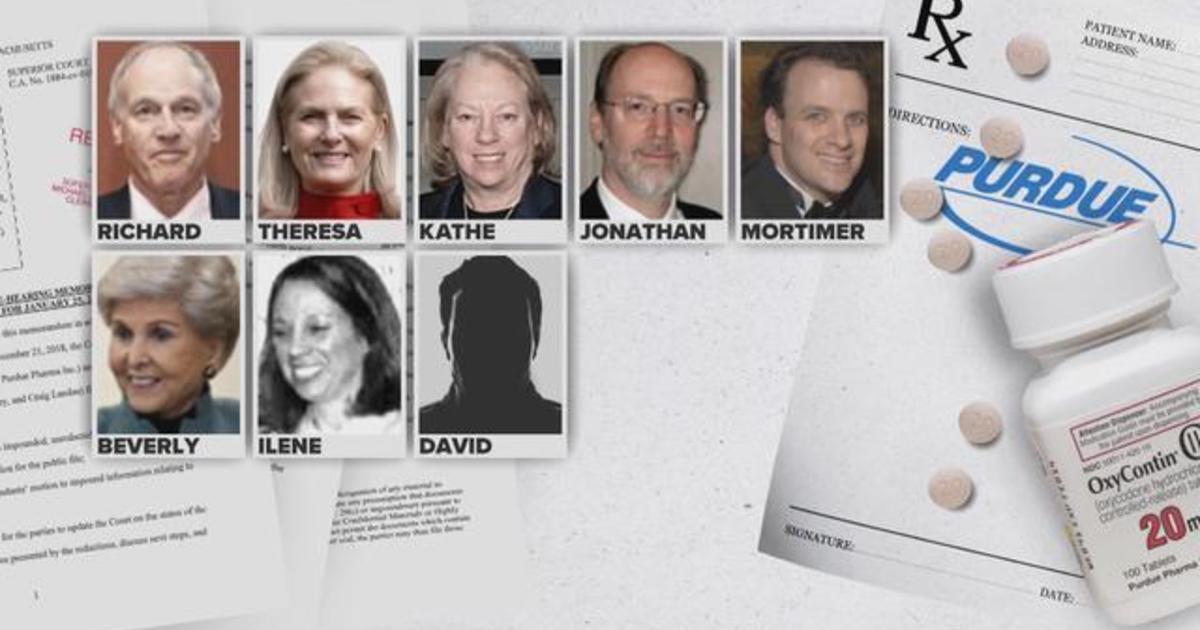

Connecticut and Massachusetts are the first two states to sue Purdue and Sackler family members simultaneously. Their lawsuit alleges that eight Sacklers sparked the opioid crisis with misleading marketing of OxyContin in the late 1990s, which allowed Purdue and the family to reap billions of dollars from flooding every state with highly addictive prescription drugs.

Purdue paid $4 billion to the Sackler family between 2008 and 2016, according to the Massachusetts attorney general’s lawsuit.

The legal scrutiny of the Sacklers is making their family investment operations in hedge funds public knowledge.

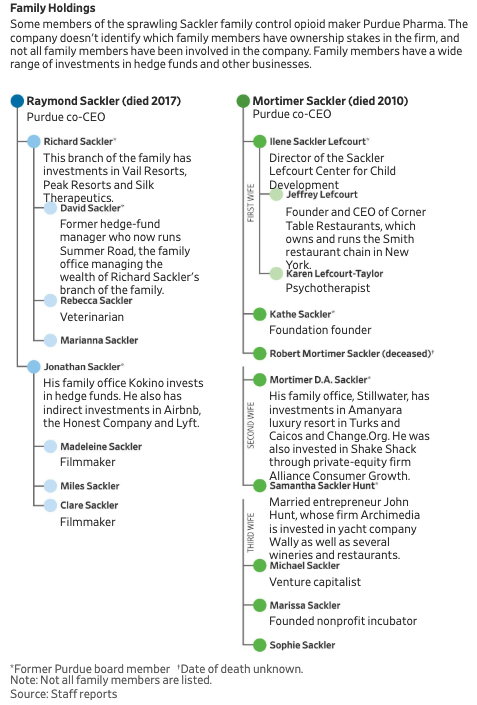

Some family members “have financial interests, directly or indirectly, in: Airbnb Inc.; Honest Co.; ski resort operators Vail Resorts Inc. and Peak Resorts; the Smith restaurant chain in New York; the luxury Amanyara resort in Turks and Caicos; and apartment complexes and hotel developments throughout the U.S.,” said the Journal. Their investments also include a biomaterials company Silk Therapeutics Inc. and a $100 stake in the firm Balter Capital Management.

The Journal said hedge funds that count the Sacklers among their clients declined to comment or didn’t respond to requests for comment.

While some members of the Sackler family directly control Purdue, not all family members are involved in the company. Family members have a wide range of investments in hedge funds and other businesses.

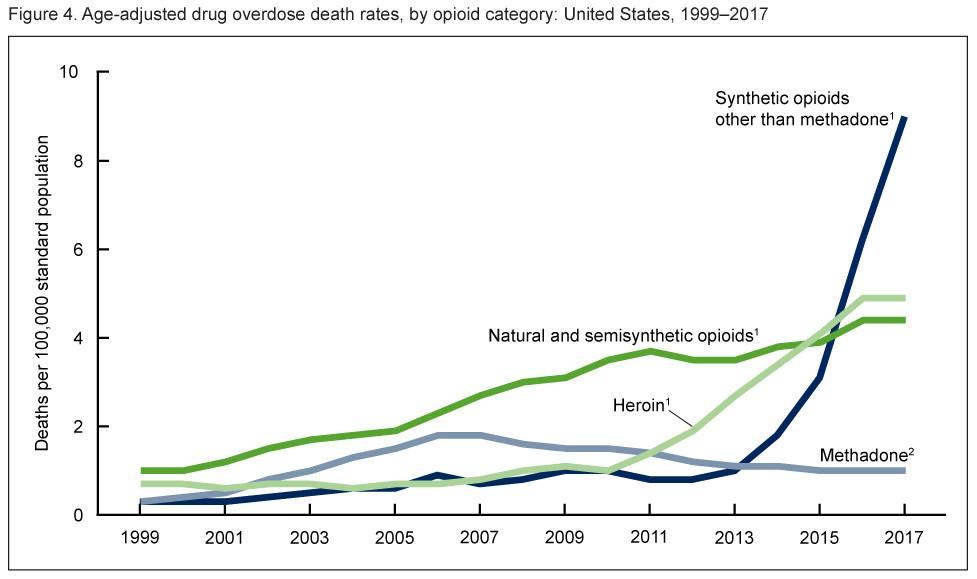

Since the Sascklers launched OxyContin in the late 1990s, deaths involving prescription and illegal opioids have quadrupled from 2.9 per 100,000 in 1999 to 13.3 per 100,000 in 2016, according to the Centers for Disease Control and Prevention.

There are 36 states and 1,600 cities and counties that have filed lawsuits against Purdue, and four members of the family have been asked to testify this month as part of cases against Purdue in Ohio and Oklahoma.

Richard, Kathe, Mortimer D.A. and Jonathan Sackler, all members of Purdue’s controlling family and former board members of the company, are scheduled to sit for depositions beginning this week. The interviews are likely to further probe family members’ roles in the company and marketing of its drugs. Mortimer D.A. and Jonathan are testifying in a case brought by Oklahoma’s attorney general scheduled for trial in May.

The legal scrutiny of the Sacklers is highlighting their family investment operations, which are some of the most sophisticated in the U.S. Branches of it are longtime investors in hedge funds, including successful early stakes in Perry Capital, which told clients in 2016 it would close, and Lone Pine Capital.

Understandably, Purdue and the Sacklers have tried to avoid scrutiny for their role in sparking the crisis as state and federal lawsuits mount. Now the family’s multibillion-dollar investment operations and charitable efforts are also facing a backlash from the finance and academic communities in the Northeastern US, which are finding themselves under pressure for their association to the Sacklers.

Some family members also have financial interests, directly or indirectly, in: Airbnb Inc.; Honest Co.; ski resort operators Vail Resorts Inc. and Peak Resorts; the Smith restaurant chain in New York; the luxury Amanyara resort in Turks and Caicos; and apartment complexes and hotel developments throughout the U.S. They have invested in biomaterials company Silk Therapeutics Inc. and backed with $100 million Boston investment firm Balter Capital Management, according to people familiar with the matter.

The family office for Raymond Sackler’s son Richard is named Summer Road LLC for a street near the Alta ski resort in Utah, near where a branch of the family owns a home that is the site of family gatherings. Summer Road, run by Richard’s son David Sackler, a former hedge-fund manager himself, has recruited nearly a dozen traders in recent years, many of whom focus on quantitative trading.

As the WSJ notes, an entity called Kokino LLC invests the wealth of Jonathan Sackler and Kokino’s employees. Kokino operates out of the same building in Stamford that houses Purdue’s headquarters, along with other investment firms with connections to the Sacklers. Purdue’s HQ in Stamford has become a site of protests by recovered addicts and people who said they had relatives who died of opioid overdoses.

Brian Olson, a co-founder of hedge-fund giant Viking Global, heads Kokino. Kokino as of late last year invested in roughly two dozen hedge funds, said a person familiar with Kokino’s operations. People familiar with Kokino said its investments include DeepCurrents Investment Group and Sunriver Management, which is housed in the same building as Purdue.

Jonathan Sackler is also an investor in Brookside Equity Partners and Soundview Real Estate Partners. Their portfolios include Airbnb, the Honest Company, Lyft, apartment and hotel developments throughout the U.S. and New York food hall operator UrbanSpace, according to their websites and people familiar with the matter.

As noted previously, Purdue is contemplating filing for bankruptcy amid the barrage of lawsuits.

___

https://www.zerohedge.com/news/2019-03-09/backlash-hedge-fund-kicks-out-family-makes-oxycontin