Group Of 10 Elite Hedge Fund Managers Made $7.7 Billion In 2018

ZeroHedge.com

Remarkably enough considering investors just endured a year that will be remembered as one of the worst for cross-asset performance in recent memory, Citadel founder and hedge fund billion Ken Griffin – who capped off a $700 million real-estate buying binge by dropping more than $450 million for properties in London and New York City – still finished the year well in the black.

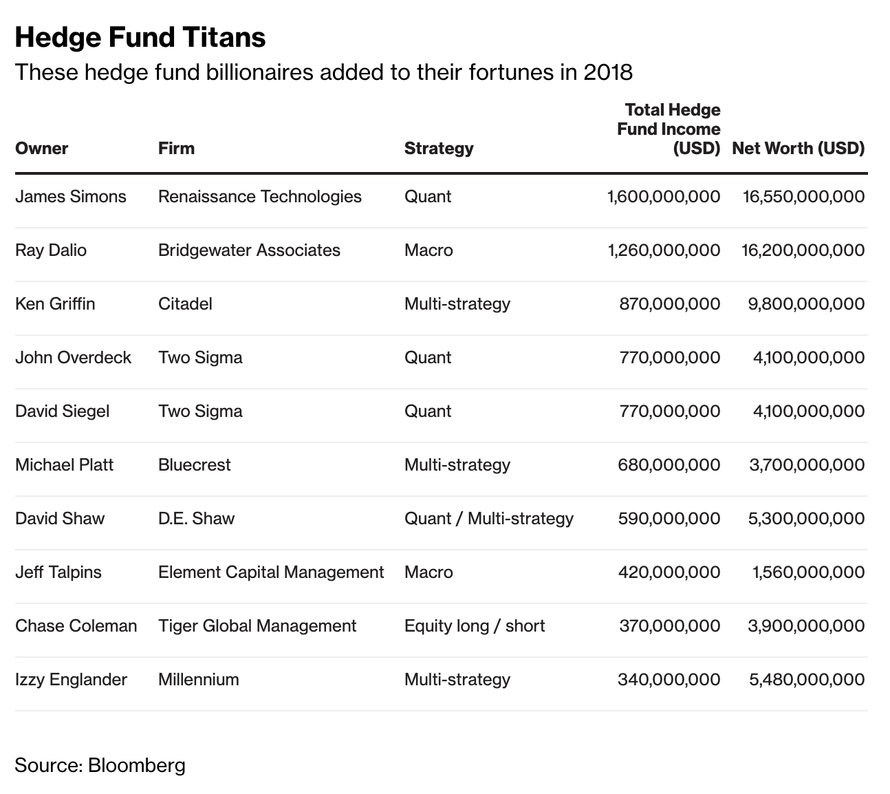

According to Bloomberg, Griffin was one of the leaders of a pack of well-compensated hedge fund billionaires who saw their wealth expand by $7.7 billion in 2018. Griffin alone saw his fortune swell by $870 million, bringing his total net worth to $10 billion.

Citadel had a good year last year, but its returns didn’t include anything on the scale of George Soros’ legendary pound short or John Paulson’s bet against the housing market. So how did he do so well?

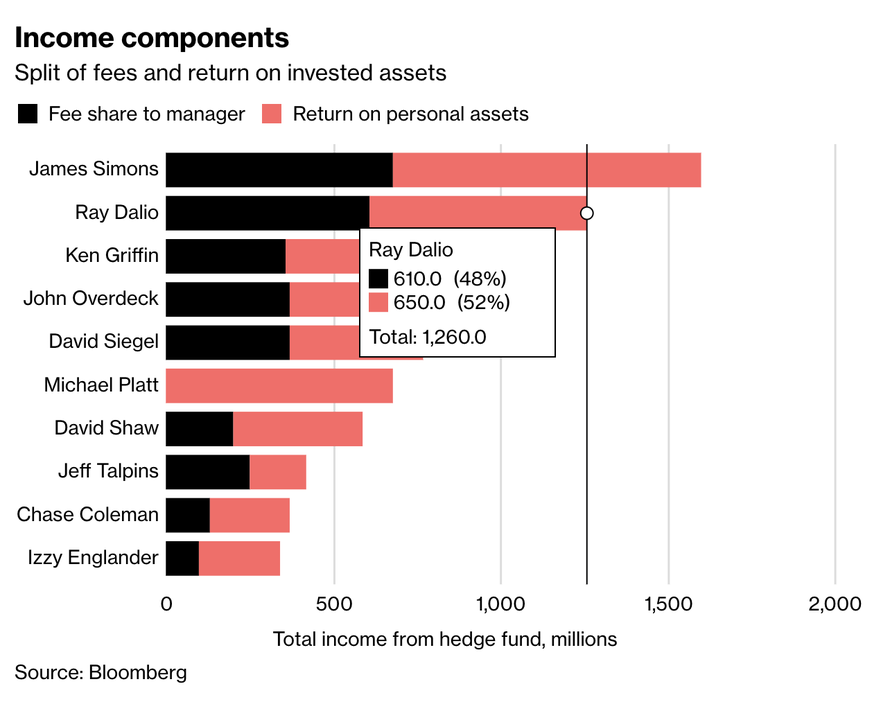

The answer is that funds like Citadel and Ray Dalio’s Bridgewater Associates have grown so large, they effectively throw off hundreds of millions – if not billions – of dollars in fees a year, even during relatively lean stretches for the market.

“We still want the mega funds to produce returns that are better than a typical hedge fund, that’s why we’re willing to pay the 2 and 20 percent fees,” said Tim Ng, CIO of Clearbrook Global Advisors, which invests in hedge funds. “We’re willing to tolerate lower performance from some in a market like 2018 because they have for years outperformed their peers.”

As Bloomberg’s ranking showed…

…quant funds dominated the competition last year.

Citadel’s flagship Wellington fund, for instance, returned 9.1 percent last year, while the average fund lost 6.7 percent, slightly worse than the S&P 500 Index. Of course, Griffin doesn’t get performance fees unless he makes a profit for his clients. As the largest investor in the funds, the billionaire’s interests are aligned with theirs.

How did other big names stack up in 2018?

Quants feature heavily on Bloomberg’s list, led by James Simons of Renaissance Technologies. The former code-breaker’s fortune increased $1.6 billion to $16.6 billion, according to Bloomberg estimates, making him the world’s wealthiest hedge fund manager.

RenTech’s Institutional Equities Fund gained 8.5 percent, while its Medallion vehicle, closed to outside investors, did better.

Ray Dalio’s fortune rose $1.3 billion, powered by Bridgewater’s approximately $160 billion of assets.

He’s now worth about $16.2 billion. His flagship Pure Alpha fund gained 14.6 percent last year, while the All Weather strategy lost money.

And while the average fund was down 6.7%, trailing the S&P 500’s ~4.5% drop, some managers crushed the competition.

Michael Platt of Bluecrest Capital Management returned 25 percent, although hedge fund investors didn’t benefit after he kicked out clients. Jeffrey Talpins of Element Capital Management had a 17 percent gain for his macro fund, elevating him to billionairedom.

For several people on the list, hedge funds are just a component of their businesses.Griffin owns one of the world’s largest firms making markets in stocks and bonds. In addition to buying houses and art, he’s given away more than $700 million to charity.

Chase Coleman of Tiger Global Management runs a fabulously successful venture capital arm, helping to boost his fortune to $3.9 billion.

And with the market in the midst of one of the best start-of-year rallies since the early 1990s, 2019 is shaping up to be an even better year across the industry…though there’s still plenty of time (and some evidence in historical market data) for things to head south from here.

___

https://www.zerohedge.com/news/2019-02-16/group-10-elite-hedge-fund-managers-made-77-billion-2018